All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (final expense coverage for seniors through brokers). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

If you choose level term life insurance policy, you can allocate your premiums since they'll stay the very same throughout your term. And also, you'll recognize specifically just how much of a survivor benefit your recipients will get if you pass away, as this amount won't alter either. The prices for degree term life insurance policy will rely on several factors, like your age, wellness standing, and the insurer you choose.

When you go with the application and clinical test, the life insurance business will examine your application. Upon authorization, you can pay your very first costs and sign any relevant documents to guarantee you're covered.

Aflac's term life insurance policy is hassle-free. You can select a 10, 20, or thirty years term and appreciate the included assurance you are worthy of. Functioning with a representative can help you find a plan that works ideal for your demands. Find out more and obtain a quote today!.

As you search for ways to protect your monetary future, you've most likely found a wide array of life insurance policy choices. level term life insurance meaning. Selecting the appropriate insurance coverage is a large choice. You intend to locate something that will certainly help support your liked ones or the reasons crucial to you if something occurs to you

Lots of people lean towards term life insurance for its simplicity and cost-effectiveness. Level term insurance, nevertheless, is a kind of term life insurance policy that has consistent payments and a changeless.

Coverage-Focused Term Life Insurance With Accelerated Death Benefit

Degree term life insurance policy is a subset of It's called "degree" because your premiums and the advantage to be paid to your loved ones remain the very same throughout the contract. You won't see any adjustments in price or be left questioning regarding its worth. Some agreements, such as yearly sustainable term, might be structured with premiums that enhance over time as the insured ages.

Fixed fatality benefit. This is also established at the beginning, so you can recognize specifically what fatality benefit amount your can expect when you pass away, as long as you're covered and updated on costs.

This frequently between 10 and three decades. You consent to a fixed premium and survivor benefit throughout of the term. If you die while covered, your survivor benefit will certainly be paid to loved ones (as long as your costs depend on date). Your beneficiaries will certainly understand in advance of time how much they'll get, which can assist for preparing objectives and bring them some economic security.

You may have the option to for another term or, most likely, renew it year to year. If your agreement has actually an assured renewability condition, you might not require to have a brand-new clinical test to maintain your coverage going. Nevertheless, your costs are most likely to boost due to the fact that they'll be based upon your age at revival time (the combination of whole life and term insurance is referred to as a family income policy).

With this alternative, you can that will certainly last the rest of your life. In this case, once again, you may not require to have any new clinical tests, yet premiums likely will increase because of your age and new protection. annual renewable term life insurance. Various companies supply numerous alternatives for conversion, make certain to recognize your selections prior to taking this step

Preferred Short Term Life Insurance

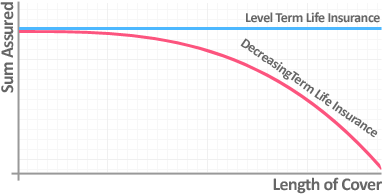

Talking to a financial expert also may help you identify the course that lines up ideal with your total approach. The majority of term life insurance coverage is level term throughout of the agreement duration, however not all. Some term insurance coverage may feature a costs that enhances in time. With lowering term life insurance policy, your death advantage drops gradually (this kind is usually secured to specifically cover a long-term financial debt you're paying off).

And if you're established for renewable term life, after that your premium likely will increase every year. If you're discovering term life insurance coverage and wish to make sure straightforward and foreseeable monetary security for your family members, level term may be something to think about. As with any kind of kind of insurance coverage, it might have some restrictions that don't fulfill your needs.

Decreasing Term Life Insurance Is Often Used To

Normally, term life insurance policy is extra budget friendly than long-term coverage, so it's a cost-efficient method to safeguard economic security. At the end of your contract's term, you have several alternatives to continue or relocate on from insurance coverage, typically without needing a clinical test.

Just like various other sort of term life insurance policy, when the agreement ends, you'll likely pay greater costs for coverage due to the fact that it will certainly recalculate at your current age and wellness. Fixed insurance coverage. Degree term supplies predictability. Nonetheless, if your monetary scenario changes, you might not have the required protection and could need to acquire added insurance coverage.

But that does not indicate it's a fit for everyone. As you're purchasing life insurance policy, right here are a couple of crucial factors to consider: Spending plan. Among the advantages of degree term insurance coverage is you recognize the expense and the death advantage upfront, making it much easier to without fretting about increases over time.

Age and health and wellness. Typically, with life insurance, the much healthier and younger you are, the more inexpensive the insurance coverage. If you're young and healthy, it might be an attractive choice to lock in reduced premiums currently. Financial obligation. Your dependents and economic obligation play a role in establishing your insurance coverage. If you have a young household, for example, degree term can help provide financial assistance during critical years without paying for insurance coverage longer than essential.

1 All cyclists are subject to the terms and conditions of the rider. Some states may differ the terms and conditions.

2 A conversion credit rating is not available for TermOne policies. 3 See Term Conversions area of the Term Series 160 Item Guide for exactly how the term conversion credit history is figured out. A conversion credit scores is not offered if costs or fees for the brand-new policy will be forgoed under the terms of a motorcyclist supplying disability waiver advantages.

Affordable Decreasing Term Life Insurance Is Often Used To

Term Series products are released by Equitable Financial Life Insurance Company (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Coverage Agency of The Golden State, LLC in CA; Equitable Network Insurance Company of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance is a type of life insurance plan that covers the insurance policy holder for a certain amount of time, which is understood as the term. Terms commonly range from 10 to 30 years and rise in 5-year increments, offering degree term insurance.

Latest Posts

Insurance To Cover Funeral Costs

Final Cost Life Insurance

Final Expense Carriers