All Categories

Featured

Table of Contents

That normally makes them a much more cost effective option for life insurance policy protection. Lots of people get life insurance policy protection to help economically shield their enjoyed ones in situation of their unforeseen death.

Or you may have the choice to convert your existing term insurance coverage into a permanent policy that lasts the rest of your life. Different life insurance coverage policies have possible advantages and disadvantages, so it's crucial to comprehend each prior to you make a decision to acquire a plan.

As long as you pay the premium, your beneficiaries will get the survivor benefit if you die while covered. That stated, it's vital to keep in mind that most policies are contestable for two years which indicates coverage can be retracted on death, ought to a misrepresentation be found in the application. Plans that are not contestable typically have a graded fatality advantage.

Premiums are normally less than entire life plans. With a level term plan, you can pick your protection amount and the policy length. You're not locked into an agreement for the rest of your life. Throughout your policy, you never ever need to stress concerning the premium or survivor benefit quantities altering.

And you can not squander your policy during its term, so you will not receive any kind of financial gain from your past protection. As with various other kinds of life insurance policy, the expense of a level term policy relies on your age, protection demands, employment, way of living and wellness. Typically, you'll discover a lot more cost effective protection if you're younger, healthier and less risky to guarantee.

Secure Term 100 Life Insurance

Because level term costs remain the very same throughout of protection, you'll know exactly just how much you'll pay each time. That can be a huge assistance when budgeting your costs. Degree term insurance coverage additionally has some adaptability, enabling you to personalize your policy with extra features. These frequently been available in the form of motorcyclists.

You may need to meet certain problems and certifications for your insurance company to enact this motorcyclist. Additionally, there might be a waiting period of approximately 6 months before working. There additionally can be an age or time limitation on the insurance coverage. You can include a youngster biker to your life insurance plan so it also covers your children.

The death benefit is normally smaller, and insurance coverage generally lasts up until your kid transforms 18 or 25. This cyclist may be an extra economical method to assist guarantee your kids are covered as riders can often cover several dependents at once. As soon as your kid ages out of this protection, it may be feasible to convert the motorcyclist right into a new plan.

When comparing term versus permanent life insurance policy. group term life insurance tax, it is necessary to keep in mind there are a couple of different kinds. The most common type of permanent life insurance policy is whole life insurance coverage, however it has some vital differences compared to degree term coverage. Here's a basic overview of what to consider when comparing term vs.

Whole life insurance lasts for life, while term protection lasts for a specific duration. The premiums for term life insurance policy are typically lower than whole life insurance coverage. Nonetheless, with both, the costs stay the exact same throughout of the policy. Entire life insurance policy has a cash money value component, where a part of the premium may grow tax-deferred for future requirements.

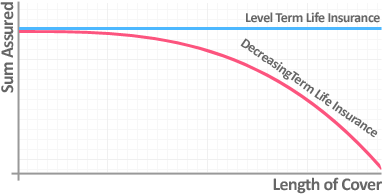

One of the highlights of level term protection is that your costs and your death advantage do not alter. With decreasing term life insurance policy, your premiums continue to be the same; nonetheless, the survivor benefit quantity gets smaller sized over time. As an example, you may have insurance coverage that starts with a survivor benefit of $10,000, which might cover a home loan, and afterwards every year, the survivor benefit will certainly decrease by a collection amount or portion.

Due to this, it's typically a more inexpensive kind of degree term protection. You might have life insurance policy through your company, yet it might not suffice life insurance for your needs. The first action when getting a plan is figuring out how much life insurance you require. Consider variables such as: Age Family members size and ages Work status Earnings Financial obligation Lifestyle Expected last expenditures A life insurance policy calculator can assist determine just how much you need to begin.

After deciding on a plan, complete the application. If you're approved, sign the documents and pay your first premium.

Leading Short Term Life Insurance

Consider scheduling time each year to examine your policy. You might intend to upgrade your beneficiary info if you've had any kind of significant life modifications, such as a marriage, birth or separation. Life insurance policy can in some cases feel complex. You do not have to go it alone. As you discover your options, consider discussing your demands, desires and worries about a monetary expert.

No, degree term life insurance doesn't have cash money value. Some life insurance policy plans have a financial investment attribute that permits you to develop cash money worth in time. A portion of your premium payments is reserved and can make rate of interest over time, which expands tax-deferred during the life of your coverage.

Nonetheless, these policies are usually considerably extra expensive than term coverage. If you reach completion of your policy and are still to life, the protection ends. However, you have some options if you still desire some life insurance policy coverage. You can: If you're 65 and your protection has actually run out, as an example, you may wish to buy a brand-new 10-year degree term life insurance policy policy.

Innovative Direct Term Life Insurance Meaning

You might have the ability to convert your term coverage right into an entire life plan that will certainly last for the rest of your life. Numerous kinds of degree term plans are convertible. That implies, at the end of your coverage, you can convert some or every one of your policy to whole life coverage.

Degree term life insurance policy is a policy that lasts a set term usually between 10 and thirty years and features a level fatality advantage and degree costs that remain the same for the whole time the plan is in effect. This suggests you'll understand exactly just how much your payments are and when you'll need to make them, permitting you to budget accordingly.

Level term can be an excellent choice if you're wanting to acquire life insurance policy coverage for the very first time. According to LIMRA's 2023 Insurance coverage Measure Research Study, 30% of all grownups in the U.S. requirement life insurance policy and do not have any type of sort of plan yet. Degree term life is foreseeable and economical, which makes it among the most popular kinds of life insurance policy.

Latest Posts

Insurance To Cover Funeral Costs

Final Cost Life Insurance

Final Expense Carriers