All Categories

Featured

Table of Contents

Plans can also last until defined ages, which in most cases are 65. Past this surface-level information, having a greater understanding of what these strategies involve will certainly help guarantee you buy a plan that satisfies your demands.

Be conscious that the term you pick will influence the costs you spend for the plan. A 10-year degree term life insurance plan will certainly set you back less than a 30-year policy because there's less opportunity of a case while the plan is energetic. Reduced risk for the insurance provider corresponds to reduce costs for the insurance policy holder.

Your family members's age must likewise affect your plan term selection. If you have little ones, a longer term makes feeling because it safeguards them for a longer time. Nevertheless, if your children are near their adult years and will certainly be financially independent in the future, a shorter term could be a much better fit for you than an extensive one.

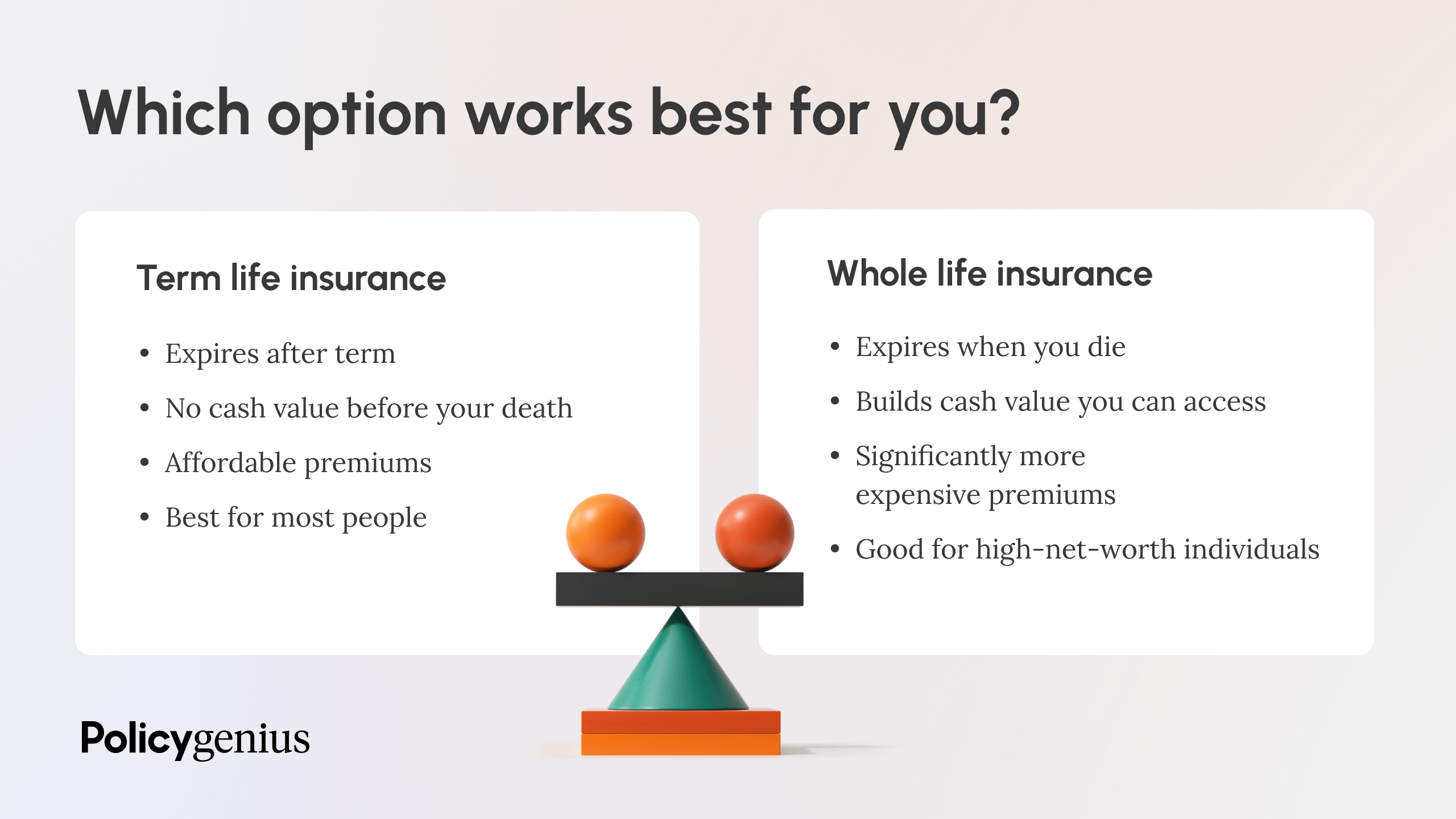

Nevertheless, when contrasting entire life insurance policy vs. term life insurance policy, it deserves noting that the latter generally costs much less than the previous. The result is more insurance coverage with reduced premiums, giving the most effective of both globes if you need a significant amount of protection yet can't manage a more costly policy.

What is Level Premium Term Life Insurance? An Essential Overview?

A level survivor benefit for a term plan typically pays as a lump amount. When that takes place, your successors will obtain the entire quantity in a solitary payment, and that amount is not taken into consideration earnings by the internal revenue service. For that reason, those life insurance policy proceeds aren't taxed. Nevertheless, some degree term life insurance policy firms enable fixed-period payments.

Rate of interest payments received from life insurance policy plans are taken into consideration revenue and undergo taxes. When your degree term life policy ends, a couple of various points can occur. Some protection terminates instantly without any alternative for renewal. In other scenarios, you can pay to extend the plan beyond its initial date or transform it into a long-term plan.

The downside is that your eco-friendly degree term life insurance policy will include higher premiums after its first expiration. Ads by Money. We may be made up if you click this ad. Ad For newbies, life insurance policy can be made complex and you'll have concerns you want answered prior to committing to any policy.

Life insurance policy business have a formula for calculating danger making use of death and rate of interest (Voluntary term life insurance). Insurers have hundreds of customers securing term life policies at the same time and utilize the costs from its energetic policies to pay surviving recipients of other policies. These business make use of death tables to estimate the amount of people within a particular group will certainly submit death claims annually, which details is made use of to determine ordinary life spans for possible policyholders

Additionally, insurer can spend the cash they get from premiums and raise their earnings. Since a degree term policy doesn't have cash money worth, as a policyholder, you can not spend these funds and they don't supply retirement revenue for you as they can with entire life insurance policy policies. Nonetheless, the insurance company can spend the cash and gain returns.

The list below area information the pros and disadvantages of level term life insurance policy. Foreseeable premiums and life insurance policy protection Streamlined plan structure Prospective for conversion to irreversible life insurance policy Limited coverage duration No cash value build-up Life insurance costs can boost after the term You'll find clear benefits when comparing degree term life insurance policy to various other insurance coverage kinds.

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations. Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies.

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. term life insurance for mortgage protection agents recommend. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow

What is What Is A Level Term Life Insurance Policy and Why Does It Matter?

You constantly recognize what to anticipate with affordable degree term life insurance policy coverage. From the moment you get a plan, your premiums will never ever transform, assisting you plan financially. Your insurance coverage will not vary either, making these policies reliable for estate planning. If you value predictability of your settlements and the payments your successors will certainly obtain, this sort of insurance policy might be a great suitable for you.

If you go this course, your premiums will enhance yet it's always excellent to have some versatility if you want to keep an energetic life insurance coverage policy. Eco-friendly degree term life insurance coverage is an additional option worth considering. These plans allow you to keep your present plan after expiry, supplying adaptability in the future.

What is What Is Direct Term Life Insurance? A Beginner's Guide

Unlike a entire life insurance coverage plan, degree term insurance coverage doesn't last forever. You'll select an insurance coverage term with the very best degree term life insurance prices, but you'll no more have protection once the strategy ends. This drawback could leave you scrambling to find a brand-new life insurance policy plan in your later years, or paying a costs to extend your existing one.

Lots of entire, universal and variable life insurance policy policies have a cash worth part. With among those plans, the insurer transfers a part of your regular monthly costs settlements into a cash money worth account. This account makes interest or is invested, assisting it grow and supply a more significant payout for your recipients.

With a degree term life insurance coverage policy, this is not the situation as there is no cash worth part. As a result, your plan will not grow, and your fatality benefit will never ever boost, consequently limiting the payment your recipients will certainly get. If you want a plan that provides a survivor benefit and develops cash money worth, explore entire, universal or variable plans.

The second your policy runs out, you'll no longer have life insurance policy coverage. Level term and reducing life insurance coverage deal comparable plans, with the main distinction being the fatality benefit.

It's a type of cover you have for a particular quantity of time, recognized as term life insurance policy. If you were to pass away while you're covered for (the term), your enjoyed ones receive a fixed payment concurred when you secure the policy. You just select the term and the cover amount which you might base, for example, on the price of elevating kids up until they leave home and you could use the settlement towards: Assisting to settle your home mortgage, debts, bank card or finances Assisting to spend for your funeral expenses Aiding to pay university charges or wedding event prices for your kids Aiding to pay living costs, replacing your income.

Is Term Life Insurance the Right Fit for You?

The policy has no cash value so if your settlements quit, so does your cover. The payment stays the same throughout the term. For instance, if you obtain a degree term life insurance policy policy you could: Pick a repaired amount of 250,000 over a 25-year term. If throughout this time around you pass away, the payment of 250,000 will be made.

Latest Posts

Insurance To Cover Funeral Costs

Final Cost Life Insurance

Final Expense Carriers